GST Update Procedure!

Update Your GST Details

What is GST Modification?

GST Modification is the process by which registered taxpayers update or correct their GST registration details. As a business grows, changes such as relocation, ownership structure, new business activities, or contact details may occur.

To stay compliant and avoid penalties, it's important to keep the GST portal updated. The system allows both core field amendments (like business address or partners) and non-core field amendments (like email or authorized signatory). Timely updates maintain the validity of your GSTIN and ensure smooth tax filing and official communication.

Not updating information may lead to notices, GSTIN suspension, or issues with claiming Input Tax Credit (ITC). Staying current with your GST details is legally required.

Reasons for Modification

When is GST Modification Required?

- Change in business name or address

- Addition or removal of business locations

- Change in business constitution (e.g., proprietorship to partnership)

- Updating email ID or phone number

- Adding or removing authorized signatories

- Correction of inadvertently wrong information during registration

Common Scenarios

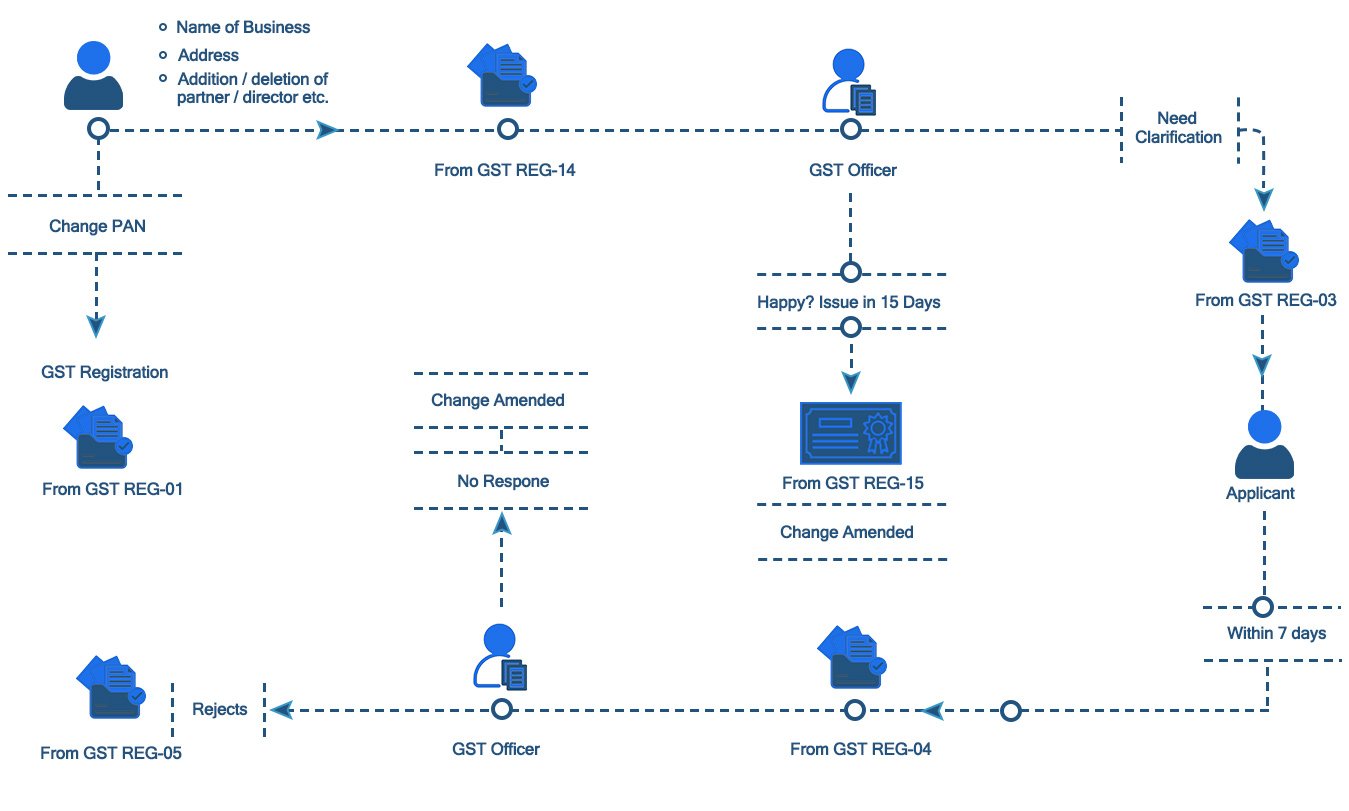

GST Modification Procedure

GST Update/Modification Procedure

Benefits of GST Modification

Why Keep Information Updated?

Stay Legally Compliant

- Ensures accurate GST records

- Prevents legal notices and penalties

- Enables smooth GST return filings

- Enhances business credibility with clients and vendors

- Facilitates communication from tax authorities

- Required for making amendments in invoices or returns

Strategic Compliance

Understanding GST Modification: A Strategic Necessity

GST Modification isn't just a procedural task; it's a strategic necessity for businesses aiming to maintain compliance and operational efficiency. Regular updates to your GST details ensure that your business reflects its current status, preventing potential legal issues and facilitating smoother transactions.

Step-by-Step Guide

Navigating the GST Modification Process

- Access the GST Portal using your credentials

- Select the appropriate amendment type (core or non-core fields)

- Provide necessary documentation (PAN, address proof, partnership deeds, etc.)

- Submit the application after review

- Receive acknowledgment from the GST authorities

This structured approach ensures that all modifications are accurately processed and compliant with GST regulations.

Overcome Challenges

Common Challenges in GST Modification

- Complex documentation requirements

- Understanding amendment types for core vs non-core fields

- Ensuring timely submission to avoid penalties

Addressing these challenges proactively can streamline the modification process and prevent delays.

Stay Compliant

The Importance of Timely GST Modifications

- Avoid penalties and legal complications

- Ensure compliance with evolving tax laws

- Maintain credibility with tax authorities and business partners

Prioritizing timely modifications safeguards your business against potential risks and ensures smooth operations.

Documents Required

- GST Registration Certificate

- PAN Card of the business

- Address proof for new or modified business location

- Supporting documents for changes (like partnership deed, board resolution)

- Identity and address proof of new partners/directors (if any)

- Authorization letter (if applicable)

- Digital Signature Certificate (DSC) for companies/LLPs

Why Choose Us

Reason for choosing us

Tailored Advice and

Support

Flexible, Client-Centered

Approach

experience

8+

of Experience